Based on the

information provided in the Figure 1, calculate the adjusted cash balance if it

is reconciled from cash per books.

CORRECT ANSWER

(B) $710,650.00

EXPLANATION

Adjusted cash balance

= Cash per books of $700,000 + Interest income of $7,000 - Bank charges of $350

+ Interest collection by bank of $4,000 = $710,650† No outstanding checks or deposits in transit

A company's records

indicate that 82 units are currently in stock, costing $50 per unit. The

physical inventory finds that only 79 units are actually on hand. Which of the

following adjusting entries is required to bring perpetual inventory records in

line with the physical count?

YOU ANSWERED: CONFIDENT

CORRECT ANSWER

(B) Debit Cost of

Goods Sold and credit Inventory for $150.

EXPLANATION

Inventory count as per

books - Physical inventory = 82 units - 79 units = 3 units; 3 units x $50 =

$150. The inventory account is reduced (credited) by $150 to mirror the

shortfall (three missing units at $50 each). To increase expenses, Cost of

Goods Sold must be debited by the same amount.

Tanix Inc. purchased

inventory of $130,000 and the transportation cost is $1,500. The company

follows a periodic inventory system. Identify the journal entry for the

purchase of inventory.

CORRECT ANSWER

(D) Debit

Purchase of Inventory and credit Accounts Payable for $130,000.

EXPLANATION

In a periodic system, when inventory is

purchased, Purchase of Inventory is debited and Accounts Payable is credited

for $130,000. It will not include the transportation cost.

QUESTION 3

Surist Inc. uses a

periodic inventory system. Surist purchased inventory worth $180,000. The

company's accountant accidentally debited Accounts Payable and credited

Purchases. Which of the following statements is true?

YOU ANSWERED: CONFIDENT

CORRECT ANSWER

(B) The company's

retained earnings are overstated.

EXPLANATION

The accountant should debit Purchases and

credit Accounts Payable. As the entry is wrong, its assets and liabilities are

understated. As expenses are understated, net income and retained earnings are

overstated.

dividing the cost of goods sold for a period by the average inventory for

that period

Utopus Inc. is

following the FIFO cash flow assumption. As per FIFO, the opening inventory

values $65,000, the purchases during the year amount to $540,000 and the ending

inventory values $95,000. Assuming the company changes its inventory valuation

method to LIFO, calculate the inventory turnover.

CORRECT ANSWER

(A) The inventory

turnover for the period is 6.375 times.

EXPLANATION

Inventory turnover =

cost of goods sold / average inventory; cost of goods sold = opening inventory

+ purchases - ending inventory = $65,000 + $540,000 - $95,000 = $ 510,000;

average inventory = (opening inventory + closing inventory) /2 = ($65,000 +

$95,000) / 2 = $80,000; Inventor turnover = $510,000 / $80,000 = 6.375 times.

Homegoods Inc. finds

that in the ending inventory of the flooring tiles, six-year-old cost is being

carried as the LIFO cash flow assumption is being applied. What will be the

impact on financial statements in the year in which the old costs are expensed?

YOU ANSWERED: CONFIDENT

CORRECT ANSWER

(B) Homegoods

Inc.'s ending inventory will have inventory items from the earlier period of

the year.

EXPLANATION

The year in which the

old costs are expensed will have inventory items from the earlier period of the

year.

QUESTION 5

Which of the following

is true of the moving average inventory system?

CORRECT ANSWER

(D) A moving

average cost is applied to the cost of goods sold for the entire period.

EXPLANATION

The moving average

inventory system uses a moving average cost to the cost of goods sold for the

entire period.

QUESTION 3

Which of the following

is true about the LIFO cash flow assumption?

CORRECT ANSWER

(C) The ending

inventory reported in LIFO in inflationary times is not realistic.

EXPLANATION

The ending inventory

reported in LIFO in inflationary times is not realistic as the real value of

the ending inventory will be higher as compared to the value as per the LIFO

cash flow assumption.

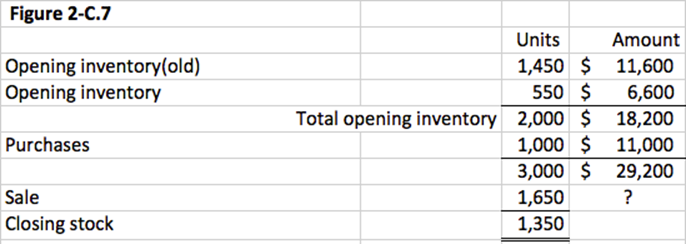

Universe Inc. follows

the LIFO cash flow assumption. It has 1,450 units of gears valued at $11,600 in

inventory for the last 3 years. From Figure 2-C.7, what is the amount of LIFO

liquidation, assuming that each unit was sold for $18 each?

YOU ANSWERED: SKIPPED

you skipped the

question

Skipped

CORRECT ANSWER

(C) $1,000.00

EXPLANATION

1,650 units sold

consist of 1,000 units of $11,000, 550 units of $6,600, and 100 units of oldest

inventory of $800. So, the LIFO Liquidation = 100 x ($18 - $8) = $1,000.

Total cost of sale..

1650..†† lifo..† last purchase is 1000@ 11000 thatís gone. Leaving

650 to account for..† the next to last

purchase of inventory is 550@ 6600 thatís gone too, now we have 100 to account

for, this comes from 1450@11600 base inventory. Dividing 1450/11600 gives us

the 8, 8x100 is the 800.† The 18 is

giving in the question the current sale amount per item.† Items of base inv. (100) times (current price

Ė base inv per item price)(18-8) is 100x10 or 1000

QUESTION 8

Larison Inc. finds

that in the ending inventory of the flooring tiles, eight-year-old cost is

being carried as the LIFO cash flow assumption is being applied. What will be

the impact on financial statements in the year in which the old costs are

expensed?

CORRECT ANSWER

(D) Larison Inc.

will have a lower ending inventory as compared to the inventory as per the FIFO

cash flow assumption.

EXPLANATION

As Larison is

following the LIFO method, ending inventory will be lower as compared to the

ending inventory as per the FIFO cash flow assumption.

dentify a feature of

the LIFO cash flow assumption.

CORRECT ANSWER

(B) The profit

taxable is lower if the LIFO cash flow assumption is followed.

EXPLANATION

The profit taxable is lower if the LIFO cash

flow assumption is followed.

QUESTION 2

Mercury,

Inc. follows the LIFO cash flow assumption. It has 4,500 units of floor panels

valued at $45,000 in inventory for the last 5 years. From Figure 7, what is the

amount of LIFO liquidation on the oldest inventory sold, assuming that each unit

was sold for $50 each?

CORRECT ANSWER

(C)

$24,000.00

EXPLANATION

This

problem can be solved in two steps. Step 1 is to identify the quantity of the

oldest inventory sold, which is calculated by taking 4,500 units sold, as given

in the problem, and subtracting 2,400 units of purchases, and 1,500 units of

the opening inventory quantity. This would leave 600 units of the oldest

inventory. Step 2 is to identify the LIFO liquidation value, which is

calculated by taking the selling price of $50 per unit and subtracting $10 from

the original value per unit (calculated by $45,000/4,500). This is then

multiplied by 600 as follows: LIFO Liquidation = 600 x ($50 - $10) = $24,000.

QUESTION 3

Ultra Energy Corp.

finds that in the ending inventory, five-year-old cost is being carried as the

LIFO cash flow assumption is being applied. What will be the impact on

financial statements in the year in which the old costs are expensed?

CORRECT ANSWER

(A) Ultra Energy

Corp. needs to add the value of old inventory in the cost of goods sold in the

year it is expensed.

EXPLANATION

In the year of expense, Ultra Energy Corp.

needs to add the value of old inventory in the cost of goods sold in the year

it is expensed.

QUESTION 4

Which of the following

is true about the moving average system?

CORRECT ANSWER

(A) In this

system, moving average is applied to ending inventory.

EXPLANATION

In the moving average system, moving average

is applied to ending inventory.

Select a feature of

the LIFO cash flow assumption.

CORRECT ANSWER

(D) LIFO reports

low profit in inflationary times in comparison to other methods of cash flow

assumption.

EXPLANATION

LIFO reports low profit in inflationary times

in comparison to other methods of cash flow assumption as the expensive recent

inventory is taken to the cost of goods sold.

QUESTION 2

Jupiter Inc. follows

the LIFO cash flow assumption. It has 440 units of floor panels valued at

$5,280 in inventory for the last 6 years. From Figure 1-C.7, what is the amount

of LIFO liquidation assuming that each unit was sold for $40 each?

CORRECT ANSWER

(A) $4,200.00

EXPLANATION

4,200 units sold consist of 2,550 units of

$66,300, 1,500 units of $37,500, and 150 units of the oldest inventory of

$1,800. So, the LIFO Liquidation = 150 x ($40 - $12) = $4,200.

QUESTION 3

Homegoods Inc. finds

that in the ending inventory of the flooring tiles, six-year-old cost is being

carried as the LIFO cash flow assumption is being applied. What will be the

impact on financial statements in the year in which the old costs are expensed?

YOU ANSWERED: CONFIDENT

you gave the correct

answer

(B) Homegoods Inc.'s ending inventory

will have inventory items from the earlier period of the year.

QUESTION 4

Identify a feature of

the moving average system.

CORRECT ANSWER

(C) It

reclassifies costs from inventory to cost of goods sold at the time of sale

until the next purchase is made.

EXPLANATION

The moving average system reclassifies costs

from inventory to cost of goods sold at the time of sale until the next

purchase is made.

Which of the following

is true about the LIFO cash flow assumption?

CORRECT ANSWER

(C) The ending

inventory reported in LIFO in inflationary times is not realistic.

EXPLANATION

The ending inventory reported in LIFO in

inflationary times is not realistic as the real value of the ending inventory

will be higher as compared to the value as per the LIFO cash flow assumption.

QUESTION 2

Universe Inc. follows

the LIFO cash flow assumption. It has 1,450 units of gears valued at $11,600 in

inventory for the last 3 years. From Figure 2-C.7, what is the amount of LIFO

liquidation, assuming that each unit was sold for $18 each?

YOU ANSWERED: CONFIDENT

you gave the correct

answer

(C) $1,000.00

QUESTION 3

Which of the following

is true of the moving average inventory system?

CORRECT ANSWER

(D) A moving

average cost is applied to the cost of goods sold for the entire period.

EXPLANATION

The moving average inventory system uses a

moving average cost to the cost of goods sold for the entire period.

Identify a feature of

the moving average system.

CORRECT ANSWER

(C) It

reclassifies costs from inventory to cost of goods sold at the time of sale

until the next purchase is made.

EXPLANATION

The moving average

system reclassifies costs from inventory to cost of goods sold at the time of

sale until the next purchase is made.

(C) It

reclassifies costs from inventory to cost of goods sold at the time of sale

until the next purchase

QUESTION 4

Charles Tech Corp. has

acquired 700 shares of Melia Computers for $7.5 each. Melia computers has

50,000,000 shares outstanding at the time of purchase by Charles Tech Corp. It

has no intention of selling these shares in the foreseeable future. Using which

accounting method will the shares be reported in the financial statements?

CORRECT ANSWER

(B) Accounting

for available-for-sale securities

EXPLANATION

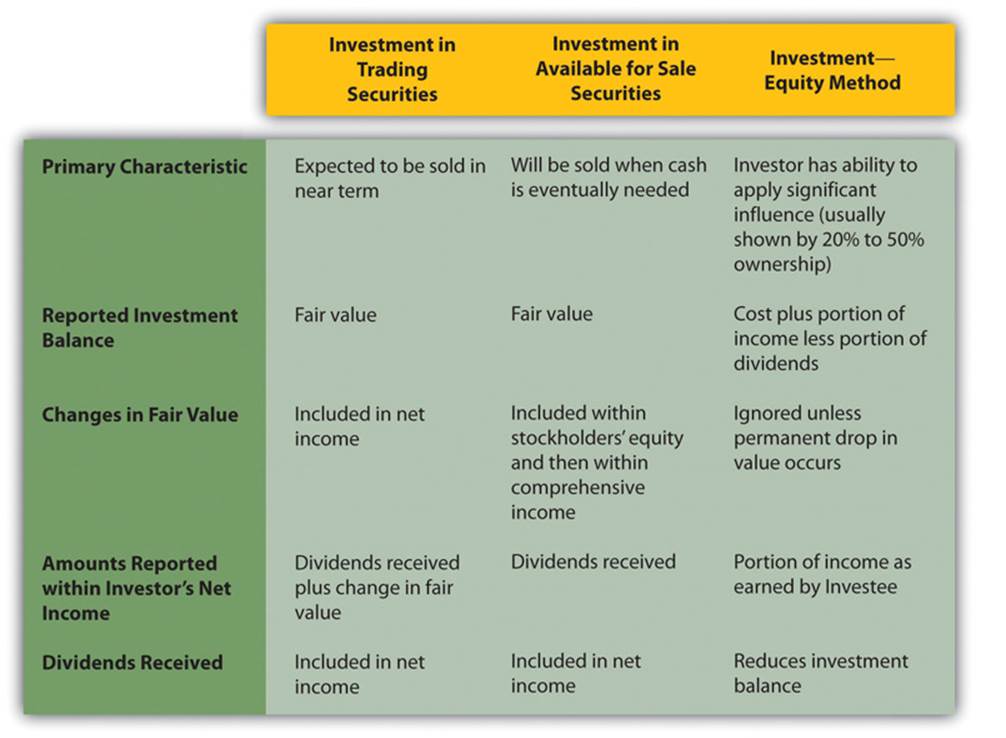

Since the shares do not provide any control

over Melia computers, accounting for mergers and acquisitions and accounting

for investments by means of the equity method cannot be used. Also since,

shares are not intended to be sold in the foreseeable future, accounting for

trading securities cannot be used. The shares will be reported in the financial

statements using accounting for available-for-sale securities method.

QUESTION 5

A company has acquired

certain investments which are to be accounted using equity method. At what

value would the investment be reported in the balance sheet?

CORRECT ANSWER

(C) Cost plus

portion of income

EXPLANATION

Investments accounted using equity method are

reported at cash plus the portion of income value in the balance sheet.

QUESTION 6

Zhong Car Company

received dividends worth $1,500 from its investment in shares of Yu Motors and

$1,000 as dividends from Zi Motor Company. It reported both these dividends as

income for the year. The company has recorded the appreciation from Zi Motor Company

as income for the year. Which of the following statements is most likely to be

true?

CORRECT ANSWER

(D) The

management of Zhong Car intends to sell shares of Zi Motor Company in the near

term.

EXPLANATION

Since appreciation from Zi Motor Company was

accounted for as income for the year, they are classified as investments in

trading securities. Investments are classified as such only when they are

intended to be sold in the near future.

QUESTION 7

Harry Musicals pays

its annual rent of $12,000 in advance for the year on the first day of January.

On the last day of March, Harry Musicals passes the following entry in its

books.

Prepaid Rent $9,000

Rent Expense $9,000

What can be concluded from the information provided?

CORRECT ANSWER

(A) It recorded

rent premium paid on January 1st as an expense.

EXPLANATION

The given journal entry is passed as an

adjustment entry when the original entry recorded is rent expense.

QUESTION 2

Nigel Corp had paid

annual insurance on its premises in advance in the previous year. Out of this,

insurance for three months had been expensed in the previous year. In the

current year, it also paid its annual insurance expense in advance and expensed

three months out of it. What can be inferred from the information above if the

company pays monthly rent for all the remaining months in the current year?

CORRECT ANSWER

(C) Its ending

prepaid insurance account balance will neither increase nor decrease as

compared to the opening balance.

EXPLANATION

The opening prepaid rent account will have a

balance of nine months and its closing prepaid rent account will also have a

balance of nine months. Hence, there will be no change in the closing balance

of prepaid rent as compared to the opening balance.

QUESTION 3

Charles Tech Corp. has

acquired 700 shares of Melia Computers for $7.5 each. Melia computers has

65,000,000 shares outstanding at the time of purchase by Charles Tech Corp. It

has no intention of selling these shares in the foreseeable future. Using which

accounting method will the shares be reported in the financial statements?

YOU ANSWERED: CONFIDENT

you gave the correct

answer

(B) Accounting for available-for-sale

securities

QUESTION 4

Gigantic Corporation

has acquired shares of Julian Inc. at market price. It has no intention of

selling these shares in the foreseeable future. Using which accounting method

will the shares be reported in the financial statements?

CORRECT ANSWER

(B) Accounting

for available-for-sale securities

EXPLANATION

Since the shares do not provide any control

over Julian Inc. computers, accounting for mergers and acquisitions and

accounting for investments by means of the equity method cannot be used. Also,

since shares are not intended to be sold in the foreseeable future, accounting

for trading securities cannot be used. The shares will be reported in the

financial statements using accounting for available-for-sale securities method.

QUESTION 5

Claude Car Company

received dividend worth $1,500 from its investment in shares of Chantal Motors

and $1,000 as dividends from Louis Motor Company. It reported both these

dividends as income of the year. Both the shares had appreciated in value;

however, only appreciation from Louis Motor Company was accounted for as income

of the year. Which of the following statements is most likely to be true?

CORRECT ANSWER

(D) The

management of Claude Car intends to sell shares of Louis Motor Company in the

near term.

EXPLANATION

Since appreciation from Louis Motor Company

was accounted for as income for the year, they are classified as investments in

trading securities. Investments are classified as such only when they are

intended to be sold in the near future.